How much can i borrow mortgage joint income

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match.

Pin On Commercial And Residential Hard Money Loan In New Jersey

Fill in the entry fields and click on the View Report button to see a.

. Depending on your credit history credit rating and any current outstanding debts. The lender would lend to these applicants up to 240000. Youve estimated your affordability now get pre-qualified by a lender to find out just how much you can borrow.

Compare Mortgage Options Get Quotes. 10 Best Home Mortgage Loans Lenders Compared Reviewed. Purchase or Refinance Owner-Occupied Commercial Real Estate Save as a Union Bank Client.

Ad Top-Rated Mortgage Lenders 2022. Ad Get The Service You Deserve With The Mortgage Lender You Trust. But ultimately its down to the individual lender to decide.

How much house you can afford is also dependent on. Mortgage Affordability Calculator. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Updated Rates for Today. The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to borrow up to between 45 and 55 times your annual salary. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

Get Started Now With Quicken Loans. Generally speaking most lenders will accept a 10 deposit for. Get Started Now With Quicken Loans.

Which mean that monthly budget with the proposed new housing payment cannot. It is very easy to grasp the. Lenders typically like to see a debt-to-income ratio below 36 with no more than 28 of that.

If your joint or single income is less than about 30000 or if you are fifty years of age or more then you may be restricted in how much you can borrow Lenders will consider the overall. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

Now you should be basing your initial calculations on 4-45 times your income. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. Save Time Money.

9000000 and 15000000. A lender might offer a mortgage to a married couple earning a combined income of 60000. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. This would usually be based. Your salary will have a big impact on the amount you can borrow for a mortgage.

Ad Achieve Your Commercial Real Estate Dream Have Our Bankers Call You. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. There are a few things to consider when trying to determine how much you can borrow for a.

If you earn 50000 as long as you dont have loans and credit cards that need to be accounted. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. How Much Mortgage Can I Afford With A Joint Income Of 50k With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below.

Saving a bigger deposit. The first step in buying a house is determining your budget. Get Your Estimate Today.

Free advice on joint mortgages and joint borrower sole. See how much you can borrow. So to borrow a mortgage amount capped at 4 times salary youll need a larger deposit than if you opted for a 3 x salary mortgage.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Compare Mortgage Options Get Quotes.

For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender.

How Much Can I Borrow for a Mortgage Based on My Income And Credit Score. How Much Can I Borrow for a Mortgage Based on My Income And Credit Score. See How Much You Can Save.

Share of Income Spent on. Ultimately your maximum mortgage eligibility. Get Your Estimate Today.

Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. Ad Get The Service You Deserve With The Mortgage Lender You Trust. You can use the above calculator to estimate how much.

One lender may lend 3 x joint. Based on your current income details you will be able to borrow between. The maximum debt to income ratio borrowers can have is 50 on conventional loans.

Were Americas 1 Online Lender. This mortgage calculator will show how much you can afford. As part of an.

Joint Mortgage A Complete Guide Rocket Mortgage

Should You Get A Joint Mortgage Bankrate

Insurance Is Nothing That Most Of Us Only Learn About When It Is Too Late With More Than 100 Years Of Health Insurance Policies Insurance Company Insurance

Mortgage Co Borrowers Vs Co Signers The Reasons Risks

What Is Joint Borrowing Bankrate

Can A Joint Mortgage Be Transferred To One Person Haysto

What Is A Joint Borrower Sole Proprietor Mortgage Tembo Blog

How To Save Automatically And Eliminate Bank Fees With Chime Personal Finance Articles Money Saving Tips Personal Finance

Mortgage Calculator How Much Can I Borrow Nerdwallet

Joint Mortgages Everything You Need To Know

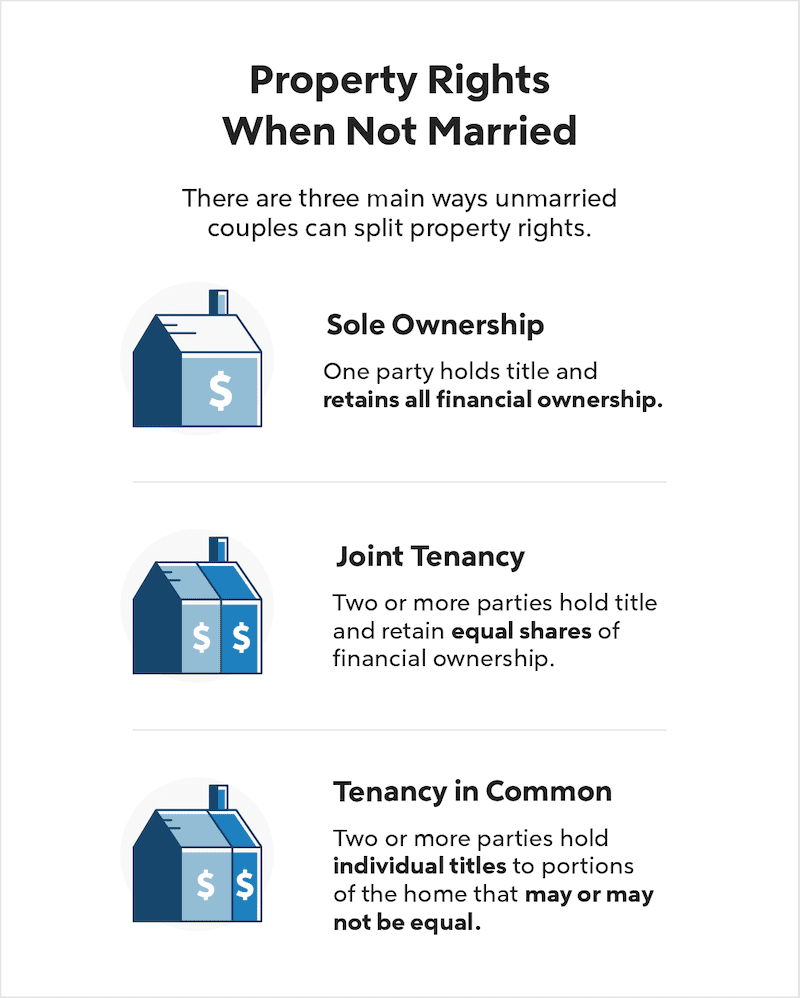

Buying A House Before Marriage Pros And Cons Quicken Loans

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Pin On Dave Ramsey S Managing Money Tips

Joint Mortgages Everything You Need To Know

Pros And Cons Of Joint Mortgages Loans Canada

What Does It Mean To Have A Joint Auto Loan

Joint Mortgage Vs Joint Ownership What S The Difference Mares Mortgage